Bettering good fortune in lifestyles and price range

| What’s inflation? Emerging inflation reasons a lower in purchasing energy through the years. It typically prices extra to buy the similar items and products and services. |

|

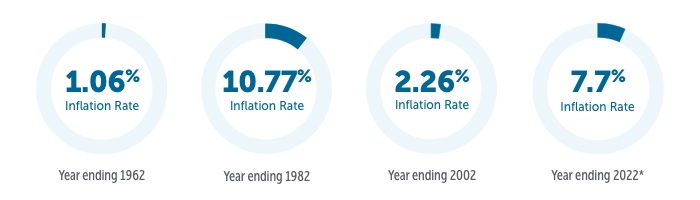

| Inflation at quite a lot of deadlines |

*12 months over 12 months finishing Might 2022 (StatsCan and Buying and selling Economics) |

Plan for and organize inflation

| Ways for managing debt | Ways for contingencies | Ways for managing money drift |

|

Imagine paying down debt or consolidating it at decrease general charges, in particular when rates of interest waft or aren’t locked-in and/or lock in decrease charges when rates of interest and inflation display indicators of accelerating.

Loan

Credit score Playing cards

Line of Credit score

|

Evaluate the volume of lifestyles insurance coverage and significant sickness protection you’ve got, adjusting for upper charge of residing and larger substitute charge of income. If inflation makes lifestyles uncomfortable if you are alive and wholesome, what is going to it do while you’re now not? Imagine segregated finances that offer promises on deposits and would possibly lock in expansion too on demise and adulthood.

Lifestyles insurance coverage Crucial Sickness |

Evaluate the place you spend your cash. Are you able to scale back discretionary spending to ease drive to pay for necessities like groceries, hire, warmth and hydro? And what’s in point of fact crucial?

Cut back leisure prices

Defer new purchases |

| Funding and Way of life Concerns |

|

Making an investment vs. Saving

Imagine how lengthy your horizon is and tackle some chance to maintain and building up the price of your investments, even in retirement which is able to most likely remaining many years. Optimize the usage of registered plans that permit for tax-sheltered expansion and possibly tax-deductible contributions. Each approaches would possibly lend a hand maintain inflation through the years. Imagine segregated finances with their quite a lot of coverage promises to lend a hand come up with a security internet. |

Greenback-cost averaging

This tactic comes to making an investment the similar sum of money at common periods (e.g. Per 30 days) irrespective of how the marketplace is doing. It reduces chance through the years and provides the chance to shop for in when costs drop, purchasing extra of the similar funding and taking emotion and marketplace timing out of the method. |

|

Diversify

A correctly various portfolio is essential to managing inflation chance and offering the chance to reach focused charges of go back through the years that meet your objectives one day. Inflation can have an effect on quite a lot of investable belongings otherwise and to other levels. Be certain your investments align together with your chance profile, time horizon and your quite a lot of targets. |

Alter. Adapt. Amend.

Identical to inflation would possibly impact quite a lot of investments otherwise, it will probably have other affects on quite a lot of sides of your way of life and possible choices. Construct in and worth flexibility. Imagine adjusting trip plans or exploring stories that charge little and supply enjoyment. Imagine retiring later, running longer or part-time. Each and every 12 months of lengthen way spending your income as an alternative of your financial savings. |

A correctly structured monetary plan can lend a hand supply course, choices, peace of thoughts, and predictability. It will let you perceive the have an effect on of inflation through the years for your talent to succeed in your objectives and do what you need to do. You’ll want to periodically tension check your plans, answers and techniques to verify they proceed to do the process they have been designed to do. Alter as vital and revel in your lifestyles.

This weblog displays the perspectives of the writer as of the date mentioned. This data must now not be regarded as a advice to shop for or promote nor must or not it’s relied upon as funding, tax or criminal recommendation. Empire Lifestyles and its associates does now not warrant or make any representations in regards to the use or the result of the guidelines contained herein in the case of its correctness, accuracy, timeliness, reliability, or another way, and does now not settle for any duty for any loss or harm that effects from its use.

An outline of the important thing options of the person variable insurance coverage contract is contained within the Data Folder for the product being regarded as. Any quantity this is allotted to a Segregated Fund is invested on the chance of the contract proprietor and would possibly building up or lower in worth. Please learn the guidelines folder, contract and fund details sooner than making an investment.

This record contains forward-looking data this is in response to the evaluations and perspectives of Empire Lifestyles as of the date mentioned and is topic to modify with out realize. The tips contained herein is for basic functions handiest and isn’t meant to be complete funding recommendation. We strongly counsel that buyers search skilled recommendation prior to creating any funding selections. Empire Lifestyles and its associates suppose no duty for any reliance on or misuse or omissions of the guidelines contained herein.

September 2022

.jpg#keepProtocol)