In my final article, I wrote about the advantages of a purchase and cling technique the place an investor stayed out there in the course of the ups and downs of a selected funding.

Let’s imagine the similar 4 pals, James, Stacey, Jasmine and Vincent and their funding behaviour beneath a distinct state of affairs. Every particular person invests $10,000 in the similar funding, the S&P/TSX General Go back Index. This time, everybody excluding James, enters and leaves the marketplace over the similar 10 12 months length, lacking one of the most worst acting days of that funding.

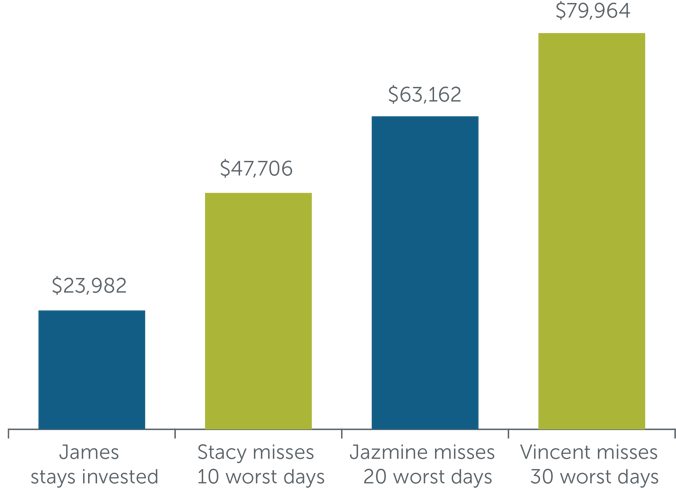

James stories the similar consequence as beneath state of affairs 1. His “purchase and cling” technique led to a achieve of $23,982. Let’s take a look at what took place to his 3 pals.

Timing the marketplace

$10,000 funding in S&P/TSX General Go back Index over 10 years

(2012-2021)

Representation simplest, no longer meant to undertaking long term efficiency of any explicit funding.

This state of affairs displays the deserves of timing the marketplace as a way to keep away from the worst days of efficiency of a selected funding.1 Right here’s the issue. The maths works however hanging the tactic into follow in order that the consequences fit this state of affairs is nearly not possible. You simplest know what the worst days were after the truth. The similar holds true for understanding when the most efficient acting days are going to be. Once more, seasoned pros are not able to boast this sort of efficiency in spite of being desirous about doing this for a residing. They cling skilled accreditation, have years of schooling, coaching and revel in and feature assets maximum buyers don’t.

No one loves to lose cash. Loss aversion can lead buyers to take a loss on paper and switch it right into a discovered loss by means of promoting equities after a marketplace downturn. Why? They need to keep away from extra losses. Sadly, this conduct may end up in lacking one of the most very best days of marketplace returns. The most efficient days generally tend to observe the worst days inside of very brief timelines. The harsh factor to do is staying invested in the course of the dips and drops of the marketplace. Profiting from the ones very best days that observe will also be key to the restoration of an funding portfolio and to optimize returns through the years. Imagine the earlier article which desirous about lacking the most efficient instances of the 12 months to be invested. It displays the danger created by means of letting feelings take fee when markets pass up and down dramatically. Timing the marketplace for your benefit is not possible when taking into consideration the small hole between the most efficient and worst days. For the reason that the worst days regularly precede the most efficient, keep invested.

Buyers who don’t undertake a longer term self-discipline of a purchase and cling technique generally tend to not outperform the markets let by myself skilled fund managers. That stated, the 2 eventualities I’ve described on this and my earlier article is also optimized when buyers undertake a buck value averaging way. This technique does no longer depend on timing the marketplace. Buyers purchase in at common periods all the way through the buildup segment in their lives and unload at common periods all the way through the decumulation levels in their lives. They view the worst efficiency days of the marketplace as instances to shop for, as a result of investments are on sale. They cling on to these investments all the way through instances when the ones investments revel in remarkable enlargement. The typical value of shopping for the funding through the years is also decrease.

Many buyers do neatly and really feel much less stressed out after they depend on pros to control the timing of purchases and gross sales of investments forming a portfolio.2 A key attention is deciding on the correct mix of investments that can assist buyers meet their targets. Any other one is the associated fee related to having investments controlled actively and the worth gained for the recommendation and making plans buyers get from authorized monetary advisors in alternate for the ones funding bills. That is any other instance of doing this for yourselves, no longer by means of yourselves. Search out a certified authorized marketing consultant that will help you out.

1 Supply: Morningstar Analysis Inc., January 1, 2012 to December 31, 2021.

2 Supply: Ivey Trade College record, “The prices and advantages of monetary recommendation,” 2013. CIRANO, The Price of Recommendation File 2012

Similar article(s)