Podcast: Play in new window | Obtain

I’ll be fair with you—scripting this submit makes me really feel a little like Jack Nicholson’s personality within the film “A Few Just right Males”. Have in mind when Nicholson is being puzzled via Tom Cruise in essentially the most memorable scene from the film and Cruise is not easy the reality?

Nicholson replies, “You’ll’t deal with the reality!”

So, what within the heck does that experience to do with calculating compound annual expansion charges?

Neatly, one of the crucial greatest secrets and techniques inside the funding business is that mutual finances, variable annuities, and numerous different merchandise tied to the whims of the inventory marketplace, put it up for sale their reasonable go back numbers in an overly deceptive method.

What is worse? They are now not breaking any rules via doing it.

I do know…there’s a collective gasp sweeping its method throughout everybody studying this.

What am I speaking about?

Having been within the monetary services and products business since 2000, I’ve spotted that the majority funding product corporations (mutual finances, ETFs, inventory marketplace indices, variable annuities, closed finish finances, REITs) like to cite their “reasonable annual charge of go back” figures which all the time inflate what the precise funding in reality returned to its traders. And it in reality bothers me.

2+2 all the time equals 4…aside from on Wall St.

This drawback is not difficult neither is it nuanced in any specific method,(because the funding business would have you ever imagine) it in reality comes all the way down to simple arithmetic.

Reasonable annual go back, as is all the time mentioned in funding literature, (advertising and marketing items, prospectuses, and so on.) is just a planned shell recreation intended to confuse your belief of the returns via declaring simple math imply calculations when the one go back that issues is the compound annual expansion charge (CAGR).

Now, I realize it appears like I am splitting hairs right here however grasp with me thru an instance and you’ll be able to perceive my red meat.

Instance: Let’s say that Invoice invests $100,000 into his funding account at J.T. Marlin (a few of you can get the Boiler Room reference) and for the first 12 months his account grew via 25% however the account returned a adverse 25% the second one 12 months.

The inventory marketplace muppets would say your reasonable go back is 0%…and so they’d be telling the reality…in the similar useless that President Clinton swore he didn’t have intercourse with that girl.

However they’re clouding the reality with nonsense–as a result of who cares what your reasonable charge of go back used to be?

Yr 1— 100,000 x 25% = 125,000

Yr 2— 125,000 x (-25%) = 93,750

If Invoice began with 100k and now on the finish of 12 months two his account is value $93,750 his precise compound annual expansion charge (cagr) used to be -6.25%.

However did not I end up within the instance that his reasonable annual charge of go back used to be 0%?

Then, how can Invoice have much less cash than what he began with?

Welcome to the glorious global of investments and the Imagineers of Wall St.

I discovered this little tidbit on-line when taking a look round to look what others had been speaking about referring to CAGR.

Investopedia.com says:

“CAGR is not the true go back in truth. It is an imaginary quantity that describes the speed at which an funding would have grown if it grew at a gradual charge. You’ll recall to mind CAGR to be able to easy out the returns.”

Truthfully, I’m speechless.

The Enron accountants have clearly taken up place of abode on Wall Boulevard and are firmly rooted in content material publishing for the monetary media.

I urge to vary with Investopedia…

Your actual go back is the one more or less go back that issues in any respect. What’s imaginary is telling Invoice (see above) that his account averaged 0% during the last two years!

Totally insane.

Who cares what I “averaged” during the last two years. If my stack of cash is shorter than after I began, that is not a zero-sum recreation.

That’s the type of communicate that might get you killed anyplace however Wall Boulevard.

So, why would the funding global all the time quote the common go back numbers?

I’m gonna come up with a minute to determine that one out by yourself.

Accomplished?

As a result of reasonable annual returns all the time glance higher than precise, actual returns.

In the event you cross over to moneychimp.com, they have got a neat instrument that allows you to have a look at the numbers as they in reality are. You’ll play with other time frames, regulate for inflation, and so on.

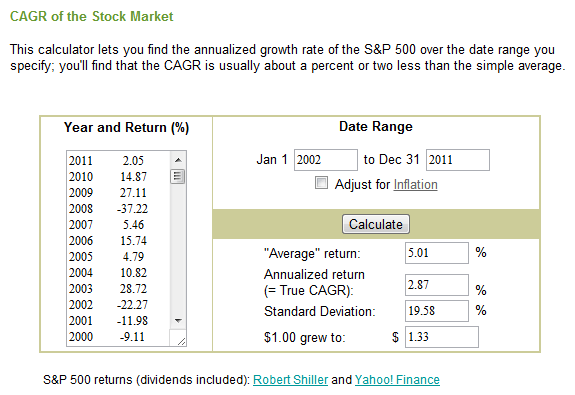

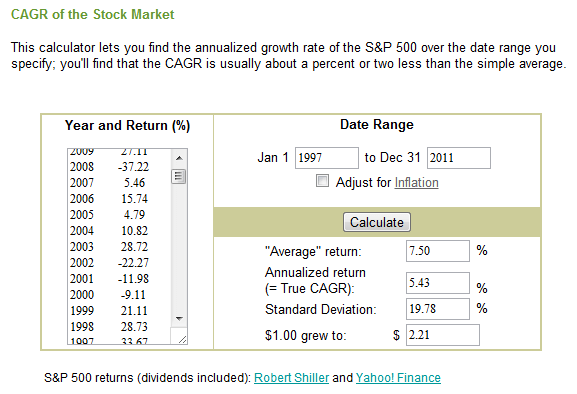

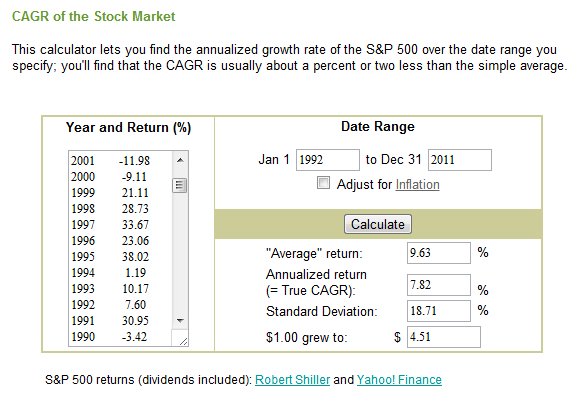

To come up with a bit of shortcut, I’ve taken a couple of screenshots to turn you the variation in precise go back (cagr) vs. reasonable annual go back during the last 10, 15, and two decades.

The reality is that almost all inventory marketplace investments are unstable and appearing you the common go back (mathematics imply) makes them extra sexy. Simply glance again on the photos, they discuss for themselves in reality.

What makes the common go back so deceptive is that there have in reality been sessions of time available in the market the place the “reasonable go back” is sure however the true go back in your cash used to be adverse.

Who cares what the common is?

That’s like speaking about an organization’s gross income…

In the event you personal a percentage of XYZ company, the one quantity that issues is web benefit. Who cares if the corporate’s profits had been $1.25 in line with percentage however the web benefit to shareholders used to be a penny?

Here is a nice quote from “The Essays of Warren Buffett: Courses for Company The usa“:

Through the years, Charlie and I’ve seen many accounting-based frauds of staggering dimension. Few of the perpetrators had been punished; many have now not even been censured. It’s been a long way more secure to thieve huge sums with pen than small sums with a gun.

Take to middle what Buffet is announcing on this quote, it applies right here.

After all additionally imagine that I’ve now not even factored within the impact that inflation has at the returns, which is every other nice function of the moneychimp website online—you’ll come with the go back numbers adjusted for inflation as smartly.

Clearly, inflation has an eroding impact at the returns in regard to each the true and the common numbers. No large marvel there.

What is in reality unlucky about this complete state of affairs, is that I believe the bulk of people that perpetuate this lie, do not know they are doing anything else incorrect! The calculations ignoring compound annual expansion charges are so embedded that even advisors, CFPs, funding advisers, and different monetary pros spout off the numbers with out wondering their validity.

I will’t say they’re being intentionally cheating however I will say that almost all are simply blind to the details.

And I am not certain which is worse?

My recommendation is to do the mathematics your self and ask a whole lot of questions. Handiest then are you able to be assured that you have made a smart resolution.