Key takeaways:

- Tactically transferring to a extra defensive positioning

- Higher bonds, diminished equities (all portfolios except for Brand Competitive Enlargement, which has no bond part)

- Brand Competitive Enlargement – larger US equities, diminished world equities

Tactical replace – December 20, 2022

We’re opting for to undertake a extra wary posture and spot more and more sexy relative worth in fastened source of revenue. As such, we’ve got decreased our fairness objectives within the quite a lot of Brand price range and larger our fastened source of revenue objectives.

The trade was once made for 2 causes which are most often similar.

- First, there’s actual possibility of a recession within the coming yr. It sounds as if that the United States Federal Reserve (the “Fed”) goes to be expanding charges for some time period however the charge of building up is more likely to average. The Fed continues to precise its purpose to stay charges in restrictive territory for a while even because the financial system is appearing indicators of cooling down.

We is also drawing near some extent the place the Fed “breaks one thing” and the marketplace, in particular the fastened source of revenue marketplace, will await that as proof begins to construct. We additionally input 2023 with the perfect bond yields in additional than a decade. This means that 2023 might not be just about as tricky for bonds, particularly executive bonds, as 2022 has been.

- Fairness markets in the meantime, are most likely going to must deal with force on income. As firms are much less in a position to go alongside upper costs however revel in persevered salary force (and nonetheless some enter price pressures) margins usually are underneath force.

As well as, whilst we’re now not overly nervous a few deep credit score cycle since firms have termed out their debt, the rise in rates of interest goes to proceed to bleed into upper pastime expense for firms as they refinance or borrow within the standard route of commercial.

Customers in fact are impacted by means of emerging pastime prices, top power prices and declining house values. This isn’t an ideal mixture.

This all suggests fairness income usually are challenged and, rhetoric apart, marketplace estimates, investor habits and valuations don’t seem to replicate this whilst somewhat top bond yields supply an alternate for an expanding portion of balanced portfolios.

Empire Existence Brand Portfolios: Asset allocation replace

*Exchange in asset combine from December 15, 2022 to December 20, 2022

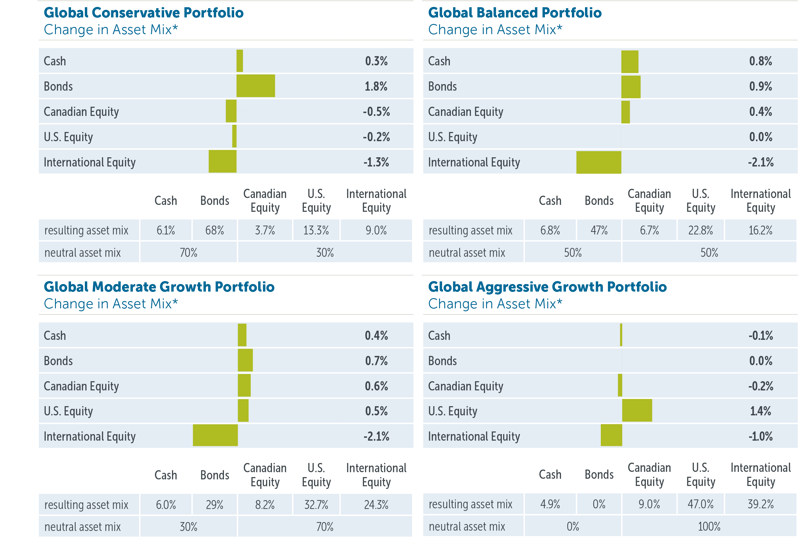

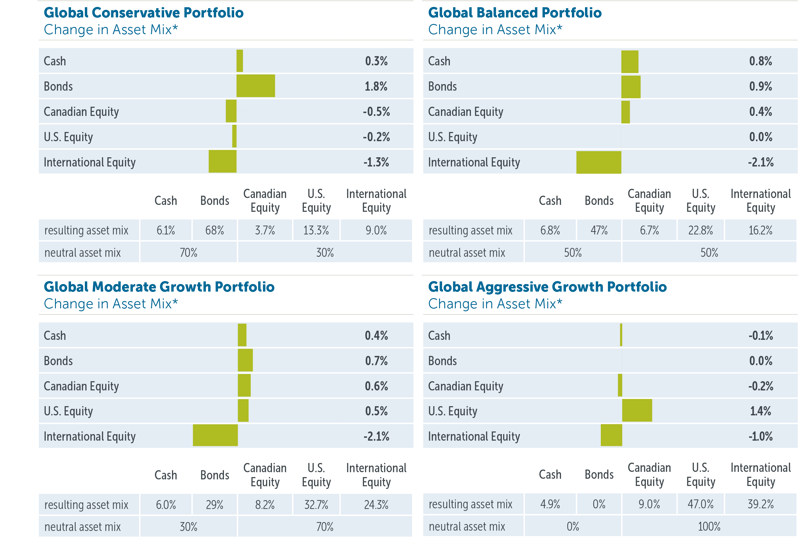

Empire Existence Brand International Portfolios: Asset allocation replace

*Exchange in asset combine from December 15, 2022 to December 20, 2022

Empire Existence Investments Inc. is the Portfolio Supervisor of the Empire Existence segregated price range. Empire Existence Investments Inc. is a wholly-owned subsidiary of The Empire Existence Insurance coverage Corporate.

Empire Existence Brand GIF Portfolios these days make investments basically in gadgets of Empire Existence Mutual Finances.

An outline of the important thing options of the person variable insurance coverage contract is contained within the Data Folder for the product being regarded as. Any quantity this is allotted to a Segregated Fund is invested on the possibility of the contract proprietor and would possibly building up or lower in worth. Insurance policies are issued by means of The Empire Existence Insurance coverage Corporate.

This report comprises forward-looking data this is according to the reviews and perspectives of Empire Existence Investments Inc. as of the date said and is matter to modify with out realize. This data will have to now not be regarded as a advice to shop for or promote nor will have to they be relied upon as funding, tax or felony recommendation. Data contained on this file has been bought from 3rd birthday party assets believed to be dependable, however accuracy can’t be assured. Empire Existence Investments Inc. and its associates does now not warrant or make any representations in regards to the use or the result of the ideas contained herein relating to its correctness, accuracy, timeliness, reliability, or differently, and does now not settle for any accountability for any loss or harm that effects from its use.

January 2023