A commonplace piece of recommendation for traders is that long run luck doesn’t hinge on timing the marketplace. It’s time available in the market that can make the larger distinction. Maximum traders aren’t pros. Authorized funding experts commit their schooling, coaching, time and sources to learning the markets and particular person corporations. But all skilled fund managers will omit the ups and downs available in the market every so often. It stands to explanation why that specific traders who check out to select the most efficient time to get into the marketplace or get out of it’s going to most probably be extra susceptible to “neglected timing”.

A commonplace piece of recommendation for traders is that long run luck doesn’t hinge on timing the marketplace. It’s time available in the market that can make the larger distinction. Maximum traders aren’t pros. Authorized funding experts commit their schooling, coaching, time and sources to learning the markets and particular person corporations. But all skilled fund managers will omit the ups and downs available in the market every so often. It stands to explanation why that specific traders who check out to select the most efficient time to get into the marketplace or get out of it’s going to most probably be extra susceptible to “neglected timing”.

Monetary advisors incessantly tout some great benefits of a purchase and hang technique mixed with buck price averaging. In particular, they recommend making an investment available in the market regularly and sticking with investments and a technique over a longer time frame.

Let’s take a look at an instance of a purchase and hang technique the place folks keep invested available in the market for quite a lot of sessions of time.

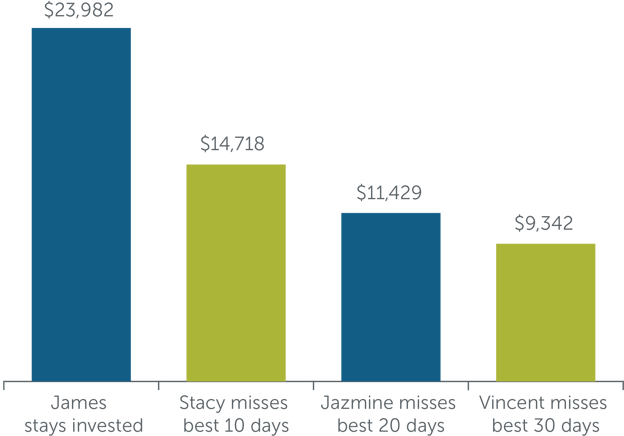

4 pals get started a casual funding membership: James, Stacey, Jazmine and Vincent. Every decide to making an investment $10,000. They pick out the similar funding, the S&P/TSX General Go back Index. They each and every make separate alternatives to take a position, get out of the marketplace for some time and reinvest throughout a ten yr length beginning in January, 2012 and finishing in December, 2021. Every individual that will get out of the marketplace for a time frame places their cash into 3 month T-Expenses. Every individual that will get out of the marketplace occurs to omit the most efficient days’ efficiency. Then they evaluate effects.

Staying available in the market

$10,000 funding in S&P/TSX General Go back Index over 10 years

(2012-2021)

Representation most effective, no longer meant to undertaking long run efficiency of any explicit funding.

This case presentations the dramatic impact of lacking even some of the best possible appearing days of a selected funding.1

James is an instance of an investor who took a long run “purchase and hang” means. In doing so, he controlled to keep away from a significant possibility of seeking to time the marketplace: lacking one of the best possible days of an funding’s efficiency.

After all, you may additionally imagine what occurs for those who omit the worst days within the efficiency of an funding. Operating with a monetary guide would possibly mean you can optimize your go back in your investments, minimize the downsides of making an investment available in the market and mean you can achieve your targets.

1 Supply: Morningstar Analysis Inc., January 1, 2012 to December 31, 2021.

Similar article(s)

Marketplace timing and lacking the worst appearing days